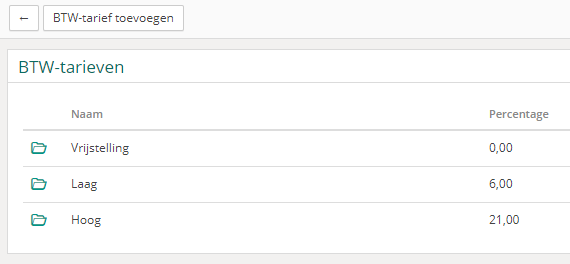

Vetocare has the most common VAT rates available from the start. The low rate (6%), the high rate (21%) and exemption (0%) are therefore immediately available in Vetocare.

However, it is also possible to add different VAT rates to your Vetocare for special situations.

To manage your VAT rates, go to "VAT settings" via your "settings".

As you can see now, you have a simple overview with all existing VAT rates in your Vetocare. To add a new VAT rate to your Vetocare, press the "Add VAT rate" button.

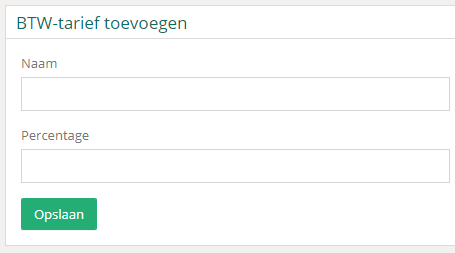

Now you have the window for creating a different VAT rate.

Name - The name of the VAT rate, for example you have "the high rate" and "the low rate".

Percentage - The percentage that amounts to the different VAT rate.

Then you just have to press "Save" to add the new VAT rate to your Vetocare!

The new VAT rate is now available when creating new invoices. You can also select a new VAT rate as the standard rate for selected products.

VAT exemption

Instead of filling in 0% VAT on every invoice Vetocare allows you to configure VAT exemption. With this exemption, invoices won't show VAT anymore so you don't have to fill it in. To configure VAT exemption you go to the VAT settings page just like the VAT rates. Under the VAT rates table you will see three options under the "VAT exemption" header.

Subject to VAT

With this option you turn off exemption, thus you will always see VAT on invoices.

Partially exempted

With this option you will see a checkbox above the product lines on every invoice. With this checkbox you can toggle whether you see VAT on that invoice. This option can be used when some invoices make use of reverse charging VAT.

VAT Exempted

With this option all new invoices won't show VAT.